Hyper-Personalized Finance | 매거진에 참여하세요

Hyper-Personalized Finance

#Finance #Open #Banking #Assets #AI #Optimizati #Data

My Own Financial World : From Institutions to Individuals

For decades, financial services were designed around banks, brokerages, and insurance companies.

But in 2025, customers are no longer just “account holders.”

We expect financial services to adapt to our lifestyle patterns, goals, and preferences.

In other words, the center of finance is no longer the bank, it’s me, the individual.

Two key drivers make this shift possible: Open Banking and AI.

Open Banking: Definition and History

Open Banking is a system where financial institutions, based on customer consent, share account, transaction, and credit data securely via APIs.

Its goal goes beyond account aggregation: it enables personalized financial services and drives fintech innovation.

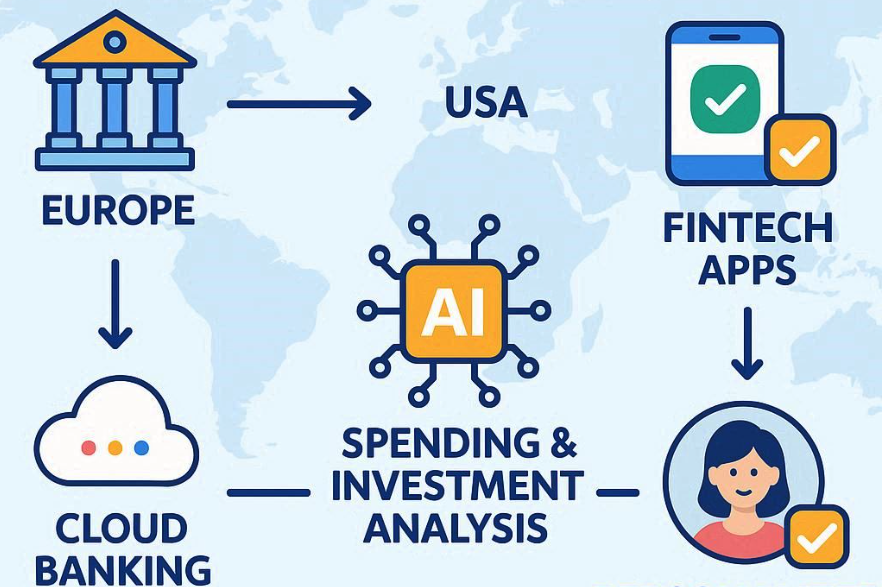

- UK: CMA mandated banks to open APIs in 2016 → official services launched in 2018

- Europe: PSD2 (adopted in 2015, enforced in 2018) → required API-based data sharing

- US: Led by players like Plaid and Yodlee

- Asia: Korea (standardized in 2019, full adoption in 2020), Singapore (API guidelines since 2016)

Why does this matter? Because it shifts finance toward customer-centric services, fintech innovation, and AI-powered personalization.

AI + Open Banking = A New UX

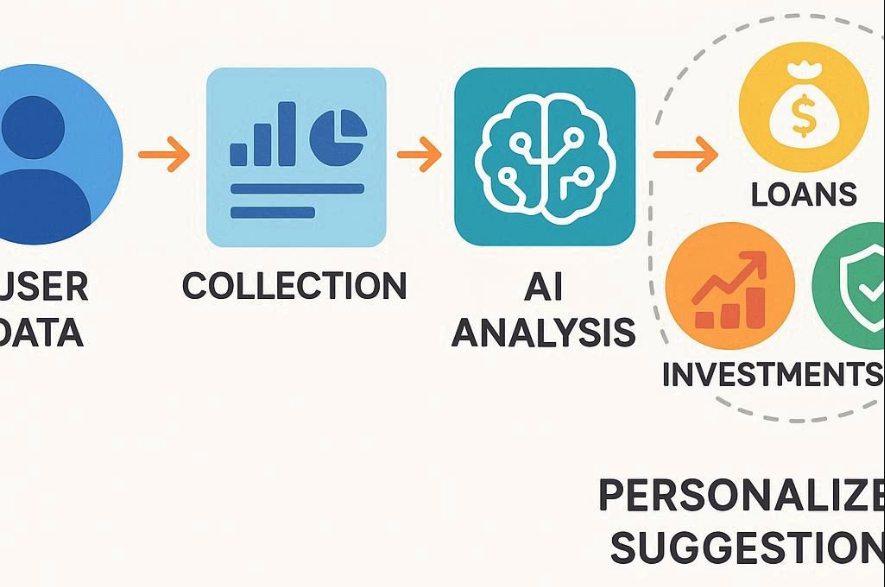

When AI analyzes Open Banking data, the result is not just information, it’s a personalized financial experience.

Trust and Security Visualization

Users often worry about data sharing.

AI optimizes permission settings, transparent alerts, and security guidance for reassurance.

Intuitive Dashboards

AI delivers spending summaries, ROI, and progress toward goals in clear visuals.

Click-through for detailed transactions or personalized investment portfolios.

Personalized Alerts & Recommendations

Real-time insights: overspending warnings, savings nudges, automated investment suggestions.

Users control notification frequency and priority.

Simplified Authentication

AI learns user authentication patterns → fewer steps, fewer errors, smoother experience.

Omnichannel Consistency

Whether mobile, desktop, or tablet, users see the same personalized insights anywhere.

Use Cases of Hyper-Personalized Finance

IT + AI Driven

AI analyzes transaction history and spending habits.

Example: 6 months of card usage → overspending in one category detected → instant alert.

Personalized investment: automatic $50 ETF monthly contribution + safe bond allocation.

Business-Oriented

Tailored loans, insurance, and investment products.

Data-driven AI consulting and subscription-based financial services for stronger loyalty.

Global Examples

Europe: N26, Revolut → Account integration + AI-driven spending analysis & investment tips

US: Mint → AI-based spending management + goal tracking & investment automation

Asia: Korea, Singapore → Robo-advisors and personalized mobile finance apps

Design-Led

Transparent dashboards + AI-powered notifications.

Clear, intuitive UX builds trust and strengthens brand value.

The Future of Hyper-Personalized Finance

The success of hyper-personalized finance depends on combining data and UX design:

IT Perspective: Open Banking APIs + AI analytics → tailored financial services

Business Perspective: Personalized products + higher customer loyalty

Design Perspective: Intuitive dashboards + trust-driven UX → stronger brand equity

In the future, a company’s ability to leverage data and design personalized experiences will define its competitive edge.

Hyper-personalized finance is not just about convenience,

it’s becoming the very foundation of how brands and customers build lasting financial relationships.